TRYING TO SURVIVE A RECESSION

and… BARCLAYS BANK

It took years to discover that the banks had ripped customers off with PPI and vehicle finance commissions – which affected millions. Most customers were compensated in thousands of pounds – enough but not life-changing though….

…. PPI alone cost the banks over £30 billion.

Little or nothing was reported about the risky loans ‘sold’ by the banks in the 1990s that cost many thousands their homes and businesses.

Unlike PPI there could be no ‘class’ action for these customers. Every case was different, and as individuals they could not afford to take legal action.

Between 1990 and 1995 over 340,000 properties were repossessed.

Back then, in the 80s and 90s, there were no emails, no internet – you only communicated, in person, on the phone, by letter or fax.

I’d never owned or used a computer until 1996.

The records that I have are all on paper – over 1000 pages

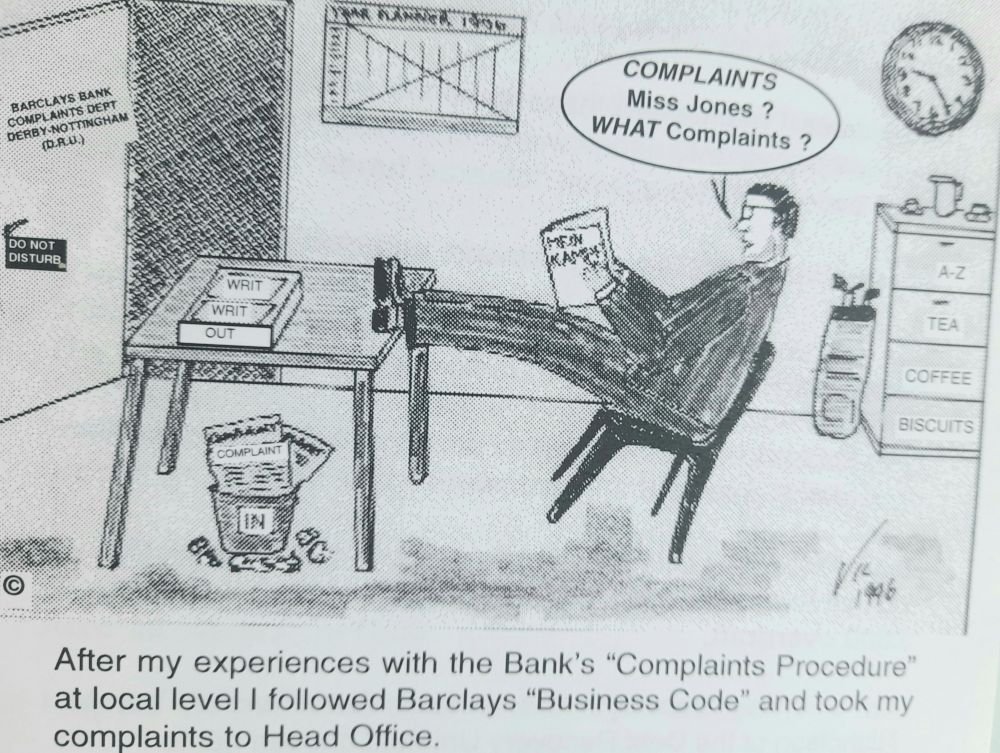

CARTOONS

I’d never drawn a cartoon until that first one, depicting what I saw as Barclays Complaints Procedure.

My solicitor told me that that one cartoon had had more effect than anything that he had done so far. The cartoons eased some of the stress of dealing with Barclays

So, I continued sending my “Illustrated letters of complaint” – they were all in black and white until THE SCAM.

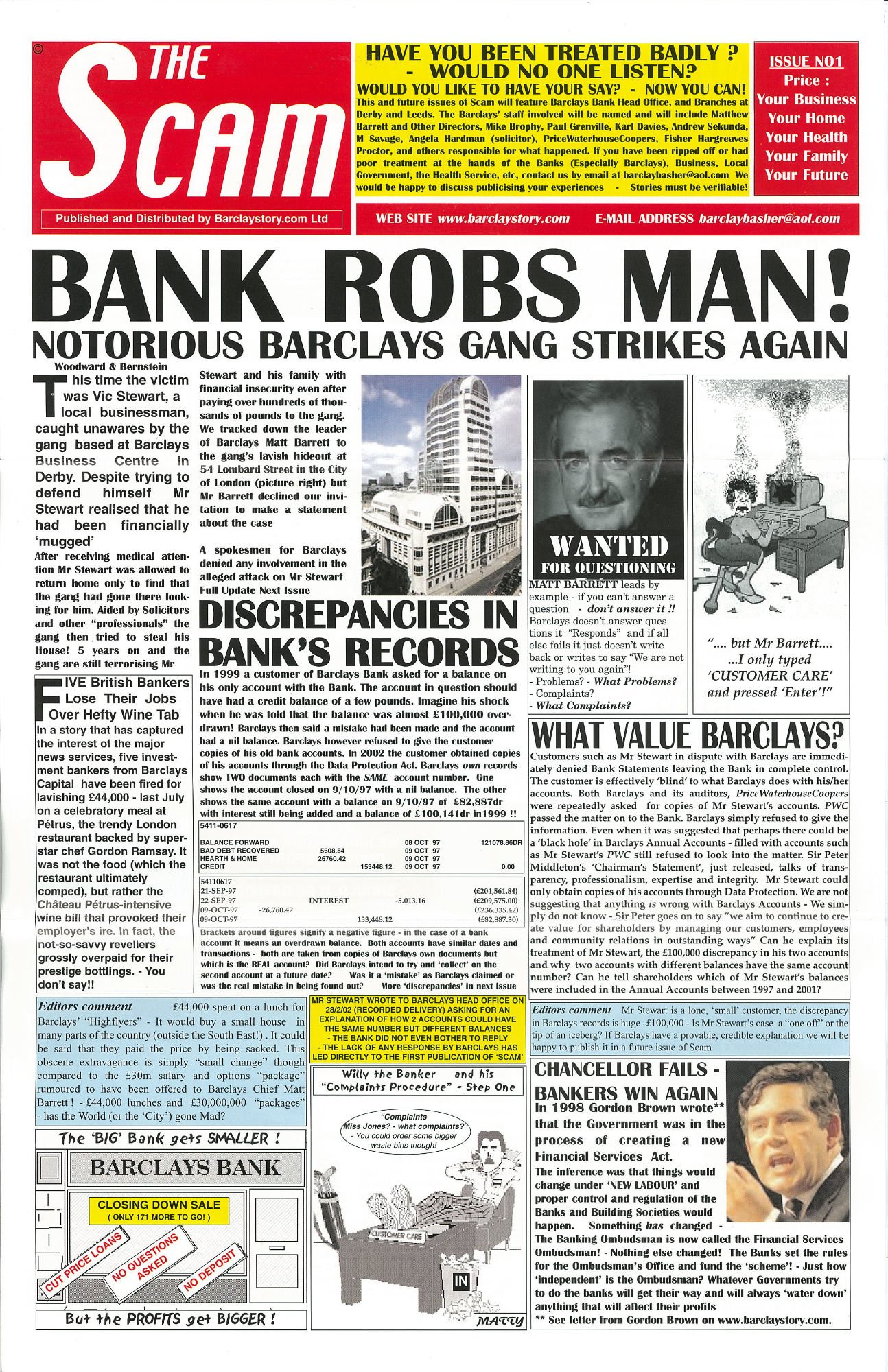

In 2001 I produced an A3 ‘spoof newspaper’ – THE SCAM – in full colour which summarised some of my complaints with cartoons. I hand delivered these around the city of Derby, to Barclays branches in Derby, Barclays Head Office in London and to anyone that I thought might be interested.

Barclays even sent me a copy of SCAM that they had on file in the documents obtained under the Data Protection Act. It was there because a staff member complained about being named in the ‘newspaper’.

Barclays took no action about THE SCAM nor the website Barclaystory.com – then an ‘amateur’ first attempt.

I have reproduced the newspaper in A4 format. I hope it will encourage you to read the whole of my story.

The cartoons may appear amusing – but they illustrate a story that wasn’t funny at all…

Those featured in the cartoons were not amused neither were those at Head Office but I do know some ordinary staff members were 😉

It’S 2025 – Why now write about what happened over 30 years ago?

There are a few reasons:

1. The events have stayed with me like an open wound.

2. The passage of time has revealed that bank reckless or risky lending did indeed happen – denied repeatedly by Barclays at the time.

3. I still have all the records – over 1000 letters, faxes and other documents.

4. In 2001 I made a Subject Access Request under the Data Protection Act which gave me copies of Barclays’ internal files and memos. Those records weren’t available when I created the first website.

5. More importantly, life moved on – we moved back to Uttoxeter Road in 1997, then moved again in 1998 to enable our children then aged 6, 8 and 10 to continue their education with friends made whilst living at Darley Abbey.

There was also, of course, a business to rebuild…