CHAPTER 2:

THE COMPLAINT, RECKLESS LENDING AND POOR ADVICE FROM “BUSINESS MANAGERS”

My Official Letter of Complaint to Barclays asked the Bank to consider the circumstances surrounding the original lending and the mismanagement of my accounts described below and in the previous page.

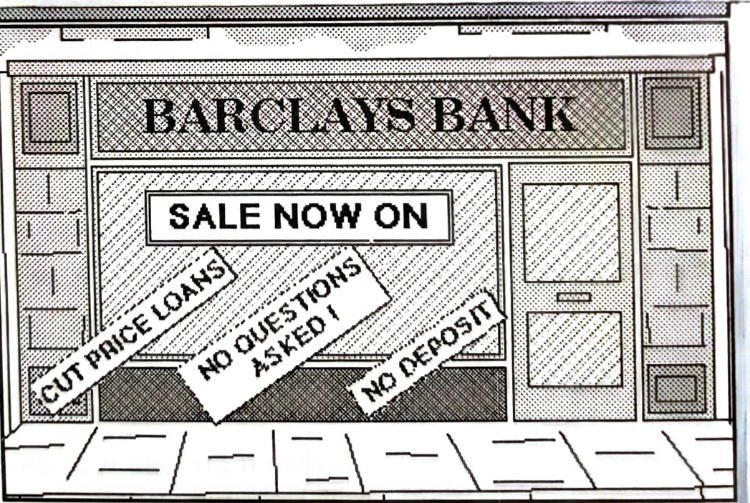

ORIGINAL LENDING

In May 1989 1 borrowed from Barclays £75,000 to purchase a property in Spain and a further £120,000 for another in Darley Abbey, Derby (a ‘do-up-and-sell’ project) in March 1990.

There were no business plans, no valuations of the properties, no deposit required and no fixed repayments.

The £75,000 loan for the Spanish property was included in business overdraft, the larger loan and interest was to be repaid when the Darley Abbey property was sold.

Our home at Uttoxeter Rd Derby was used as security on both loans.

At the time I ran a successful business in Derby, but ‘the recession’ had already begun, turnover in the business and profits were already falling and Barclays knew this at the time. Neither of the loans had any connection with my business

Barclays was acutely aware of my financial position, shown in a letter from “Barclays Business Manager” written after the first loan but months before the second loan was even considered.

Why would any bank make such loans? Barclays wont say but one explanation was that all banks were awash with money at the time and were desperate to lend it out!

Overdrafts and loans are the life-blood of banks, they simply have to lend out the money that depositors put in – how can they pay interest or make profits otherwise? Ever heard of a bank telling depositors not to make deposits?

No! The problem in 1989 was that the recession was biting and the demand for loans had dried up so bank staff were put under pressure to lend.

The only criteria seemed to be that the customer had enough collateral so that if the ‘venture’ failed the bank could recover the loan and interest – too bad if the customer was put out of business in the process! In effect banks would destroy some of its customers to survive itself.

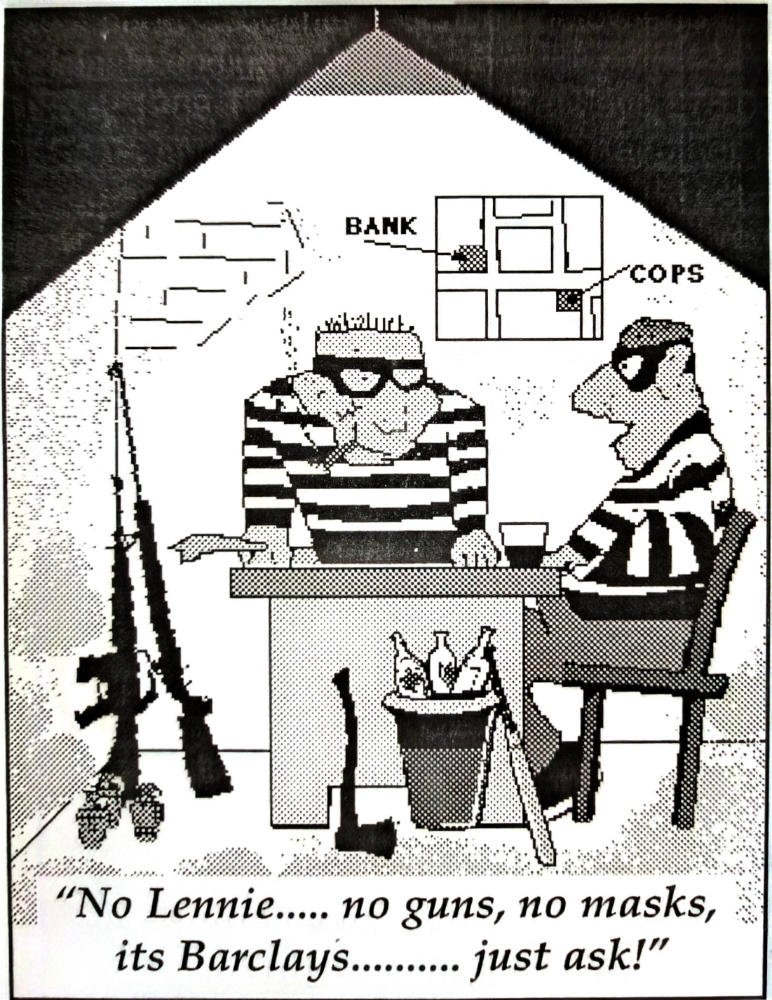

Barclays’ solicitors Edge & Ellison once wrote and said that one of the reasons for the Bank making the second loan was that – quote – ”Mr Stewart was pressing the bank very strongly at the time to provide the finance to support the project”. Apart from being an absurd reason for making any loan the statement is untrue.

Barclays were asked to explain the statement and offer proof – they refused to either comment or explain (par for the course!) What the solicitors were in effect saying was that to obtain £120,000 from Barclays without a repayment plan you simply had to do was ask! A stupid thing to say’ or was it too near to the truth? – Reckless lending!

MISMANAGEMENT OF BANK ACCOUNTS

At no time had the Bank ever suggested that we take independent advice, legal or otherwise over the loans – We relied only on the advice, or lack of it given by Barclays

Between 1990 and 1995, contrary to all that had been originally agreed, Barclays took increasing sums from our business, Up to £3000.00 per month – plus bank charges ! – To service a debt that had nothing to do with the business! Barclays even increased its rates above the 3% over base originally agreed ! – The result was inevitable. The effects of the recession and payments of up to £40,000 a year demanded by Barclays effectively destroyed the business.

We had even moved to the Darley Abbey ‘project’ in 1991 to allow our home (Uttoxeter Rd) to be rented to meet the demands of the Bank. At the time we had two children under 3 years of age. Everyone knows how stressful moving house can be, to do it with a young family and give up a comfortable home to satisfy the Bank’s demands was a real sacrifice.

Separate proposals in 1991 and 1995 to restructure the debt would have saved the business but were blocked both times by Barclays. The Bank seemed to be determined to keep us as debtors – but only on its terms!

I still do not understand why Barclays was unable to give any help or even offer advice! Did I expect too much from the “Big Bank”? or was Barclays simply looking after itself?