CHAPTER 9:

IF ALL ELSE FAILS IGNORE THE COMPLAINTS – WHO CARES ANYWAY?

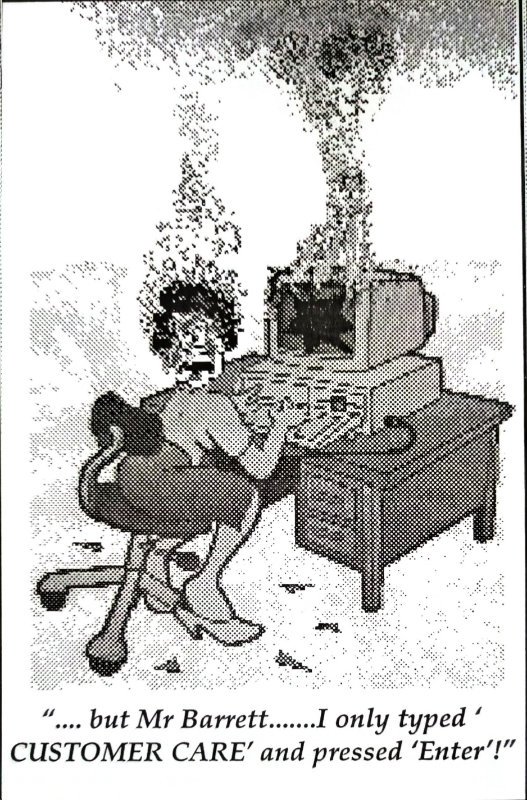

Another letter of complaint was sent to Barclays Head Office! Head Office wrote to say again that the Bank would not correspond further on the matter. So much for ‘Customer Care’ and the Bank’s promised ‘Complaints Procedure’!

The storm over cash point charges, branch closures and the ‘Big Bank’ advertising campaign shows how insensitive and out of touch Barclays is with its ‘ordinary’ customers. Didn’t anyone connected with the Bank realise for a start that the first three actors chosen to promote Barclays as the ‘Big Bank’ were best known for their roles as a cannibal (Silence of the Lambs), bungling armed gangster (Lock Stock and Two Smoking Barrels) and an armed robber in ‘Pulp Fiction’?

With nowhere else to go I formed a company barclaystory.com Ltd which launched a website www.barclaystory.com detailing the complaints and Barclays unwillingness to deal with them.

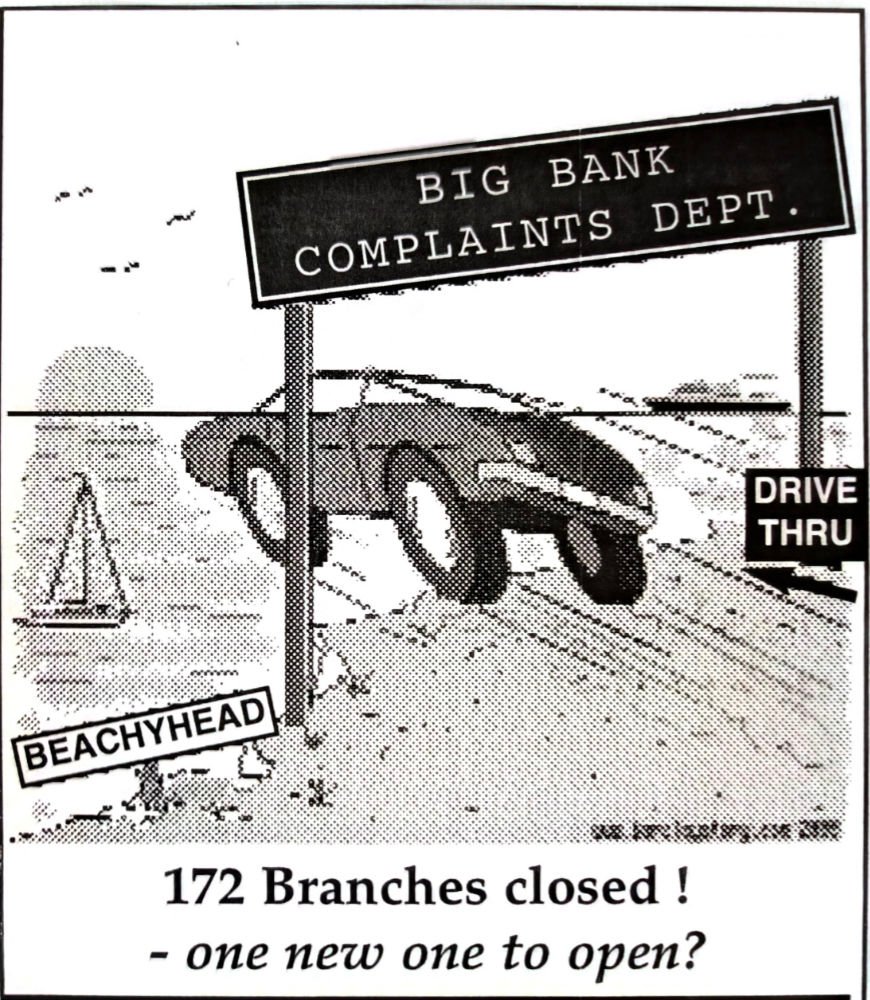

www.barclaystory.com has now launched its own advertising campaign, complete with cartoons – two are shown here.

For my part I have now taken my complaints to the Banking Ombudsman. You may ask why didn’t I do this before? I did, but The Banking Ombudsman cannot look into complaints that are subject to legal action or cases that are to do with lending – in other words most of them! I am now asking the Ombudsman to look at the complaints since the legal action. I wrote twice to the British Bankers Association, – they defended Barclays position over cash point charges, they did not even have the courtesy to reply to either letter. No – If you complain about your bank you are on your own!

I have always tried to reason with Barclays. The Barclays Business Centre Derby though was apparently unwilling or simply unable to offer advice and support.

My complaints that followed were met with indifference, arrogance and ‘dirty tricks’ that were occasionally, as a last resort, put down to incompetence by Barclays. I still believe that my original complaints of reckless lending by the Bank are valid, you may not agree.

What is painfully obvious though is that when I made my complaints Barclays had no ‘machinery’ to look into the complaints despite boasting of a “Code of Business Banking”.

Barclays deals with problems such as mine through its “Debt Recovery Units” (DRU.) which do exactly that. They have a policy of confrontation and litigation – hit the customer as hard and as fast as possible with as much legal action as is available. This policy usually works, customers Just give up In the face of action and Receivers. Barclays takes the debt, with interest plus costs and the customer is left with the ‘change’ – if he Is lucky!

Some say that I have been ‘lucky’, I don’t agree, I survived! – Barclays ruined a good business and for over 5 years has affected my health and my family. Given the same situation would I do the same again? – probably, the sense of injustice would Still be there.

Would Barclays do the same? – almost certainly ! You have read It. “Code of Business Practice”- mere words. The Bank’s own correspondence, the promise to ‘settle matters amicably’ in 1998 has never been kept. If its own “Code” and letters to Cabinet Ministers are meaningless, what chance did I have of receiving fair treatment?

Barclays calls itself the ‘Big Bank’ -It plainly Is not ‘big’ enough to admit it was wrong and put things right! The letter from Barclays chairman dated 13/11/2000 is clear – nothing will be done – nothing will change.

Barclays has to decide whether what was done to my family was deliberate or the result of monumental incompetence. Either way the damage was both considerable and unnecessary and substantial compensation is surely due.

I have failed to persuade Barclays to ‘do the right thing’, maybe it was foolish to even try. Perhaps others will now take up the ‘challenge’.

Vic Stewart