BARCLAYS FILES

THE “PHANTOM” BANK ACCOUNT

The larger loan account seemed to have two separate accounts and I now have copies of a Ledger Account No. 54110617 kept at Leeds DRU which was opened in December 1995 with a balance of £178,723.36dr When closed the account showed a balance of £98,734.52

The Original Loan Account no. 94848624 was, of course, opened in 1990 but bears a different account number. Barclays did not provide statements for this account. Both accounts showed similar transactions.

Both accounts were closed in September 1999 (Why 2 accounts?). In any case all loan accounts should have been closed in July 1997.

The “explanation” given for the ‘phantom’ account was given in a letter dated 21/09/1999 – quote:

“I do not have a deep knowledge of accountancy practices, although I fully understand that every debit has a corresponding credit. As I have already mentioned Mrs Sellers was not aware of the terms of the settlement which the Bank had reached with you. The contents of her letter do not show entries on any bank account. They show a reconstruction of an account as it would have appeared had the debt due been compromised at £41,500 with interest being chargeable on the settlement figure. The purpose of such a calculation would be to show a customer’s true liability by reflecting the full liability for interest. Because of Inland Revenue requirements it is often necessary for the bank to calculate liability in this way”

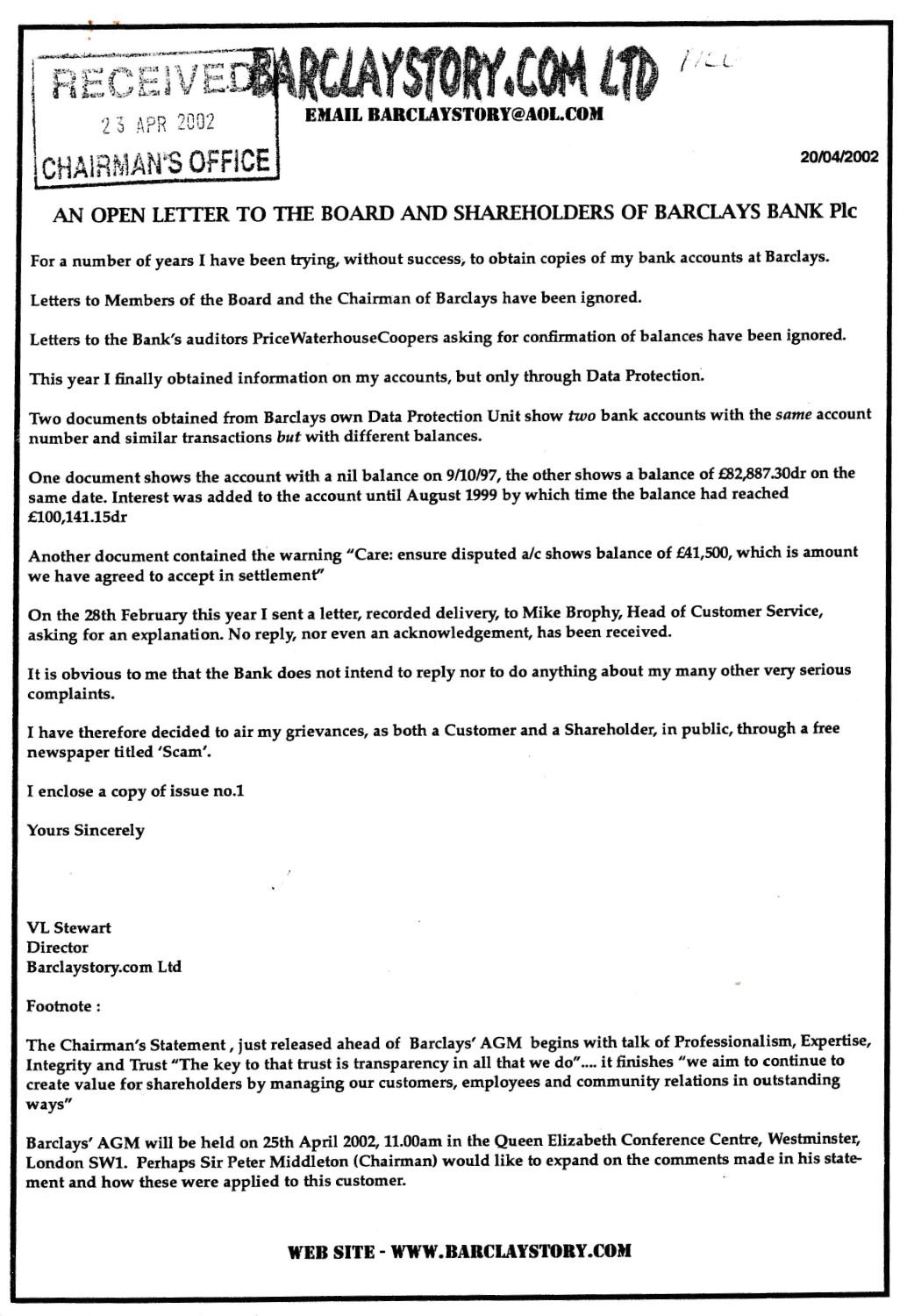

I even asked Price Waterhouse Cooper, the Banks auditors, to look into the matter and confirm my bank balances – they didn’t want to know.

I wrote many letters of complaint directly to the Chairman and other members of the Board of Barclays and copies of those were in the SAR which show numerous stamped “RECEIVED CHAIRMAN’S OFFICE”.

See below an example setting out most of my complaints:

Real figures from my records…..

| Original loans: | £195,000 |

BARCLAYS TOOK:

| Sale of Darley Abbey: | £155,500 |

| Charges and Interest PAID: | £155,396 (at least) |

| TOTAL AMOUNT PAID: | £310,896 CASH |

Add the value of the Legal Charge, £41,500 and Barclays nearly doubled the return on the original loans.

Moving on… 2002 we concentrated on bringing up our young family, our second child was born just a few weeks after the purchase of the ‘project’, and our third at the ‘project’ in 1992’.

I also converted our former home at Uttoxeter Road to self-contained flats, all rented, which Barclays referred to in 2013/14/.

In 2008 my wife, Wanda, was having problems with balance and walking. She was diagnosed with Multiple Systems Atrophy (MSA) for which there is no effective treatment or cure. The consultant said, though, that he would help Wanda manage the condition as best he could but he told us to “Go and put your lives in order”. It was blunt, certainly, but made us make the most of every day and focus on the present rather than the past.

Wanda sadly lost her battle with MSA and passed away in August 2013.

As I was not in the best of health myself I wrote to Antony Jenkins and Mark Harding at Barclays setting out again my complaints and asking the bank to remove the Legal Charge to save my children having to deal with the bank.

Initially Barclays claimed that there were no staff still at the bank that had dealt with my case. This was only partly true, one senior member was still with the bank but the two most involved had left – KD and PG.

The reply also included a remark, presumably meant to intimidate… a ‘mention’ that the bank ‘noted’ that the Uttoxeter Road property had been converted into apartments suggesting that I hadn’t asked permission of the only mortgage holder.

A pointless remark, really, as the legal charge provided that the property could be rented and altered. I just hadn’t asked for permission. What was the point of the bank mentioning this when all I had done was at least doubled the value of the property, improving its security?

They just couldn’t help themselves… Same old Barclays. Nothing much had changed since 2002 then…

The agreement in 1997 dealt only with the loans, not the damage done to the customer. No mention of the damages claim requested by the bank before the meeting nor the counterclaim in the High Court Writ, or the rents collected by FHP.

Has anything changed now? Of course now Banks do not make such risky loans.

Conduct by Barclays Debt Recovery, its solicitors and LPA Receivers was truly shocking, dirty tricks, back-dated mail, going to the High Court early, involving my son in the County Court Possession proceedings, the charge documents, the ‘phantom’ bank account which might leave the door open to further legal action…

Has Barclays changed? – It hadn’t in 2013/14

I believe the debt recovery unit at Leeds was closed.

Barclays Business Centre in Derby closed in 2019 and remained empty until this year.

The two main ‘actors’ – KD, Head of Law Section, had left Barclays in November 2001 after 29 years. PG, Head of Secretariat, had left in 1999 after 21 years with the comment “what didn’t I do at Barclays?!”

No doubt the various parties will say that their records have been destroyed as they have said before, at least twice. If they need copies, I have them…

Google ‘risky loans 1990s’ and ‘Barclays Bank DRU Leeds’. It will pretty much confirm everything that you have read here.